The probability of randomness. Although this may seem like quite the oxymoron, this is what the stochastic process encompasses. Defined as a family of random variables, the stochastic process evaluates probabilities at given time points by looking at randomized variables. This means that the observed variable changes at each time interval. Although stochastic processes were originally theorized in the 1930s by mathematician Khinchin, they have evolved enormously to solve modern-day problems. They have been widely used to model bacterial population growth, the movement of gas molecules, and the fluctuations of electoral currents due to thermal noise. However, its uses do not end there.

The next big step in stochastic processes has been to integrate them into financial markets. One of Fieldston’s own teachers, Mr. Chu, used to work in the world of finance, dealing wth mortgage backed securities. While he was working, the stochastic model was still in its primitive days. However, even back then, he claims it was an extremely powerful tool. He blamed its original failure on one big problem⸺lying. Brokers were often lying to their clients. Additionally, stochastic models at the time were based on historical defaults that were not yet reached. The model had simply not existed for long enough. But now, as time has passed, the stochastic model has become an integral part of the financial world.

The two main models used in finance are the deterministic model and the stochastic model. Deterministic models allow one to calculate a future event exactly, assuming no randomness. For example, one was to invest $1,000 in the market at an annual interest rate of 2%. According to a deterministic model at the end of one year, the investment will be worth $1,020. It is called deterministic because the results can only be determined if the inputs are known exactly. Many financial planners use a cash flow model powered by a deterministic model for long term investment decisions like pensions, where the projection rates do not change by a lot. Due to their simplicity it allows them to compare different providers.

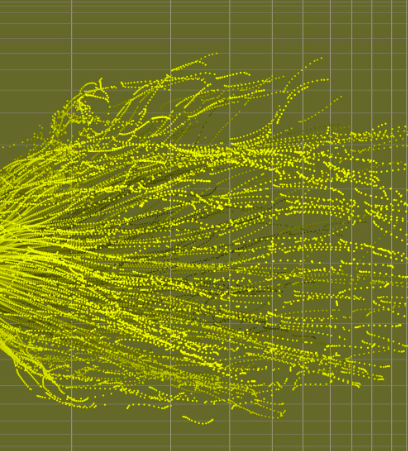

A simple example of deterministic (left) versus stochastic (right) models.

However, unlike the deterministic model, the stochastic model allows investors to account for uncertainties in their models. They are helpful in markets that are particularly volatile, and can make a good prediction on whether an investor will run out of money or make it. What makes them more sophisticated than their deterministic counterparts is that they give a range of possible outcomes, rather than one deterministic outcome. The uncertainty that is essential for stochastic processes is what makes them useful in analyzing outcomes for things such as investment returns, and inflation rates.

There are two main types of stochastic models used, Mean Variance Covariance (MVC) and the Economic Scenario Generator (ESG). In the MVC, the mean is the average return, the variance is determined by how much the market value of an investment changes, and the covariance is a measure of how different types of assets behave relative to one another. This stochastic model assumes that these three aspects remain constant for all durations. The ESG uses complex algorithms to model how the economy and various factors interact with each other. It creates a real world model of the world’s economies that allow asset classes and other returns to be created.

The quality of the MVC model is impacted by the time period that performance is measured. Too short of a period might give a prediction that is inaccurate to longer term projections. Too long of a period can include factors that are no longer relevant or accurate. Additionally, the MVC does not take into account how long an investment is held for since the average return is assumed to be constant, regardless of the investment length. Therefore they are used cautiously for longer term investments. Contrasting this, the ESG forecasts outcomes more realistically, as it does not rely entirely on historical data. Rather, using real life characteristics of assets, it creates many plausible economic scenarios. Due to this difference to the MVC, the ESG can take into account asset characteristics depending on how long they are held for.

An ESG forecast of how the same investment would be risk rated over different lengths of time

With deterministic rates using only a single rate of return, giving misleading results, and MVC models making assumptions of the factors affecting the rate of return, the advancement of financial models has helped investors. Overall, the ESG stochastic model provides investors with the tools to make informed decisions about where to put their money. It gives a wide range of possible outcomes, alongside accurately calculated risks and returns of each outcome.